Maybe you are planning to rent a new place to live, buy yourself a first home or a new car, or you just need some kind of loan. However, you cannot do any of this if you do not have all the necessary documents with you. Keep in mind that the real paystub is a very important part of that and view it as something you should always have. So, you may have been working for a company for a long time and you haven’t gotten this yet, but that doesn’t diminish its importance. This actually means that this is not so important to your superiors, but it certainly is to you.

The great news is that you don’t have to wait for anything, you can get this document yourself. All you need is a paycheck stub maker. Either way, if you’re still not quite sure you’ll ever need it keep reading. We have singled out for you several important situations in which it is necessary to have proof of income with you. Find out exactly what situations we mean below.

1. Applying for a personal loan

During this process, you need to enclose all the necessary documents, and proof of income should be found among them. Only in this way can you meet all the conditions, and this is taken so that lenders have security. This refers to your ability to repay the loan. So, once you have proof of your income, they will be able to conclude whether you really can do it or not. Keep in mind, however, that every lender is different. And because of that, they can make different demands on you. Most of them will only ask for basic things you can show them by presenting them real paystub. And to have one, all you need is just online paystub generator like www.paystubsnow.com and you will have real paystub in a matter of minutes.

2. Applying for a car loan

When you apply for this type of loan, you need almost the same documents as with the previous loan, only with minor changes. Either way, the lender’s request is always the same! They also want to make sure that you will be able to repay your debt or repay the loan during the car loan. In order to be convinced of this, among other documents, they are looking for proof of income in the form of a real paystub. When it comes to the format of this document, there are some differences that will depend on the amount of your debt. So, some lenders will focus on the monthly outcome while others will want to have an insight into your annual earnings.

3. Tax costs

When it comes to annual taxes, you won’t have to worry as long as you have a real paystub with you. This will be a document that will say something more about your tax payment. So, based on the annual salary, it can be very easily determined by this method how much income you had and how much you paid in taxes. Lastly, it is also proof for health benefits and other tax purposes.

4. Home rental

If you have decided to look for a new home that you would like to rent, it is important to be ready for some things. First, you need to be able to afford such a life, and then have the evidence that you really can. Whether you have chosen only one apartment complex or you are in cooperation with an agency, you need to pay the costs every month. They will want to have an insight into your overall earnings that you have earned so far. And based on that, he will make a conclusion about your business. This refers to the length of work.

It happens that you stay rejected if it is determined that you work very short, because that gives them space to doubt that you will stay in that job. This automatically means that you would not be able to pay regularly, because there is no constant flow of income. On the other hand, if you have been employed for a long time, it will help you with approval.

5. Net payment

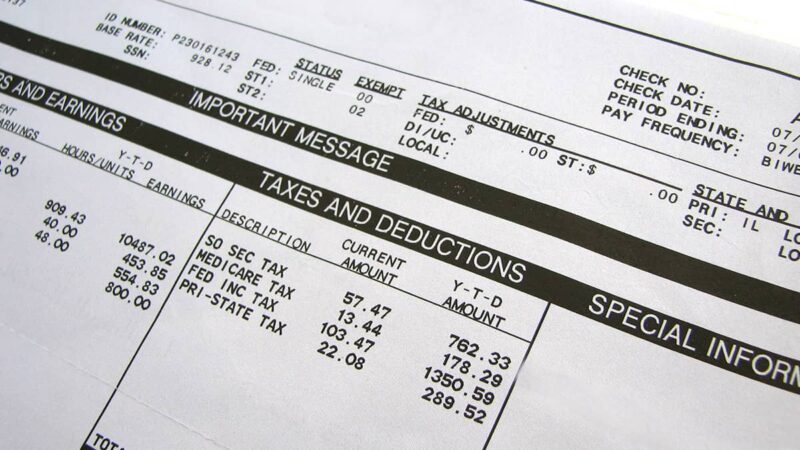

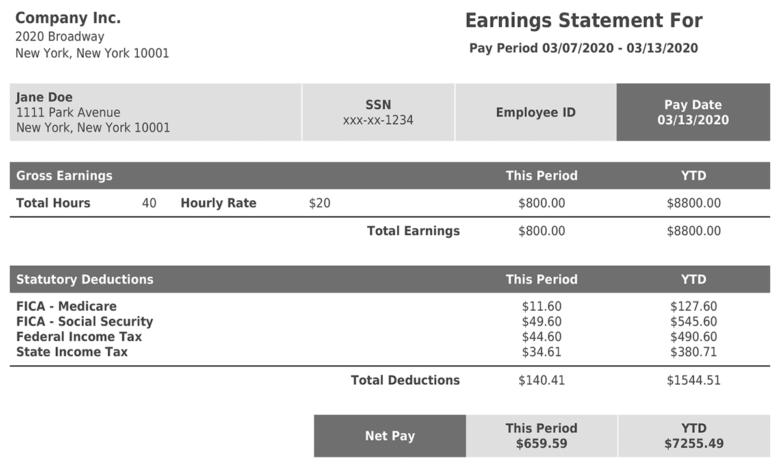

You may suspect or your supervisor really didn’t pay you properly, but don’t rush right away. Keep in mind that mistakes are a normal thing and that they happen to everyone, especially when it comes to a large amount of information in one place. Either way, you don’t have to guess when you have a real paystub. This should contain all the valid information. Based on them, you will very easily check if an error has occurred, because gross income is recorded here like everything else. So, you have an insight into the bill before and after taxes and insurance.

Factors that can lead to confusion are various taxes and insurances, overtime work that is not paid, undefined tax, etc. However, without this paper, it will be much harder for you to prove that you are not well paid.

6. History of previous salary

This includes the name of the company you were employed for, your job position and the income you earned while working for your previous employer. So, it is very important that you have this information with you if you go for a job interview. Keep in mind that each company has its own business policy that includes this or not. Either way, when you have a real paystub you can very easily verify your last job.

7. Submission of a claim for damages

Unfortunately, you also have to think about things like this. Traffic accidents are very common and sometimes there is nothing you can do to prevent them. In some worse situations, you may be prevented from working if you have experienced something like this, and then you need a real paystub. Once you have this, you can confidently file a claim for damages and thus regain your earnings. Damages can be charged from various responsible persons. As some of the common examples, we list insurance companies in different cases.

So, you can be sure because you will have proof of your standard income. Based on that, it is very clear how much money you would earn in the future, that is, how much you need to be paid.

Conclusion

Since you understand how important the real paystub is, take good care of this document. Whether you keep them in digital or paper form, always have backups with you. Also check well the pay stub you receive from your employer, there are a lot of fake pay stubs today.