In 2024, the following major trends will emerge in digital products.

Strengthening the digital channels of banking products. It began during the period of self-isolation. During the period of self-isolation in 2024, digital products received a new impetus for development with https://fireart.studio/fintech-app-development-digital-banking/.

Meanwhile, the share of daily active users (banks and fintechs) increased by 20%.

Banks will actively transform into ecosystems.

If a couple of years ago financial institutions offered their clients a standard set of services. Now they have become platforms that have:

- banking services;

- investment services;

- services for the purchase and delivery of both food and various consumer goods;

- tax and insurance services;

- E-entertainment;

- telecommunications.

Personalization and accessibility

If everything is more or less clear with the personalization of banking products, then everything is not so clear with the second term.

Accessibility. Equal access to content for all users. It includes those who have any impairments. It’s vision, hearing, musculoskeletal system, impairments associated with memory or data perception.

That is, by increasing the availability of banking products, we will increase its efficiency. It satisfies the user in achieving his goals. One hundred percent availability means using the full functionality of the product for absolutely any user. It includes those with limited capabilities. According to UN statistics, about 15% of the world’s population has some kind of restrictions (permanent or temporary). Having achieved 100% availability of the banking product, it will be possible to attract additional users. It will be beneficial for both parties.

To develop product offers, it is necessary to formulate the subject of analysis. The products used, the client’s activity, financial wealth, age and social category.

The result will be a better product offering.

More and more often banks will use the following formula: availability of offices, user-friendliness of interfaces, staff attitude, quality of services. There is the availability of banking services.

Interface customization

This means that each user will be able to customize the interface for themselves. You can choose a theme for its design. There is the possibility of hiding financial information in the Internet Bank will be popularized. The user will be able to customize how information will be displayed in the application. While this has nothing to do with the technical features of the banking apps, many people find it more attractive.

Non-human – technologies and artificial intelligence

Technologies and computers are gradually adopting all processes from us, taking them under themselves. Non-human technologies are technologies that work without human intervention. A simple example, self-checkout counters in stores.

But technologies have long ceased to be the prerogative of only retail. There are financial organizations are actively developing and implementing them in their applications.

Therefore, in 2024, that the following will develop:

- voice assistants;

- call centers;

- chat bots.

They have already become an integral part of the client’s interaction with the bank. But in the future these technologies will develop and become seamless.

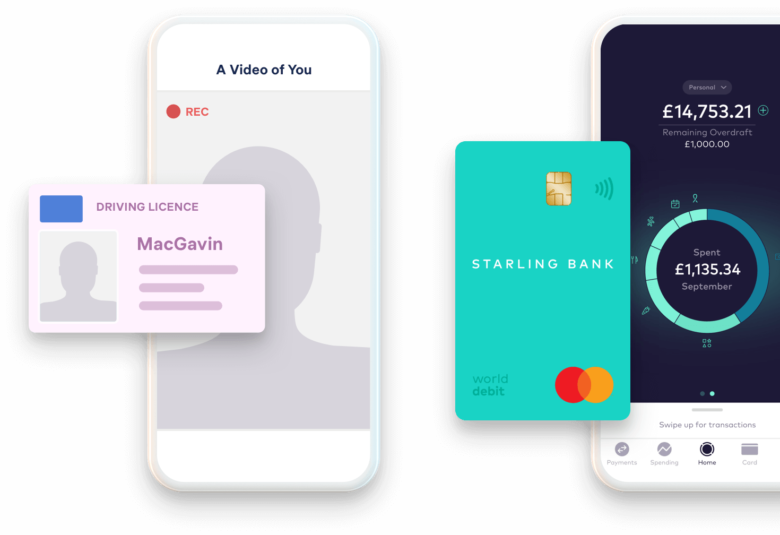

It is also expected to automate interfaces using artificial intelligence: document recognition, processing loan applications, generating personalized offers to customers, risk management and business planning, customer authentication.

All this will be left to the mercy of technologies, which, unlike people, are almost never wrong.

Benefits For Users

While there are many advantages provided for financial institutions and businesses, we have to mention the benefits for regular users as well. Considering how popular online platforms are today, digital banking became essential since it can make many processes much easier. For example, if you prefer online gambling, digital banking is necessary to provide you with the ability to transfer funds to your player’s account.

Operating with your money on the bank account is now simplified when you can use a mobile app and transfer funds whenever you want. Most banks already introduced new models of apps where you can use the NFC feature on your mobile device, which means that there is no need to carry even the credit card anymore. Also, you can save users, which means that you won’t need to type the card number and other details every time. It brings many benefits, especially if you are working with a lot of clients every day.

Moreover, it provides high security as well. The 2F Authentication is now a standard in most banks. Some of them have introduced even more layers of protection. For example, you will need to enter the code to get access to an app. After that, if you want to make a transaction, you will have to generate another code that will last for a limited time. Besides that, you can include an additional layer like a fingerprint or facial recognition.

The common problem that makes a lot of people more interested in cash can be resolved with digital banking. It is not a rare case that some people lose the sense of their spending’s when they are using a credit card instead of cash. For a long time, you had to visit the bank or ATM to check your balance. However, modern apps provide you with all details about your account at any moment.

Also, you will receive a notification each time after you spend some money. The notification will inform you about the purchase or transaction, and provide you with the current balance on your account so you will be aware of your financial status at any moment. That will help people to avoid making reckless spending’s.

Another advantage is that it will help you to save a lot of time by avoiding waiting in lines ever again. You can pay the utilities and other bills, credits, taxes, and many other things by using an app on your phone. Besides that, you can find additional information about services. For instance, getting a loan can now be finished online.

You can find more on the website, and in most cases, you will need to send the last couple of reports on your monthly income along with some other documents, and you can be able to complete the process by never visiting the bank in public. That will help the banks to save money as well, which will provide them with the ability to offer even better services in the future.

To sum up

If we do not forget that all the developments and improvements of mobile applications are aimed at the user, it turns out, the person himself acts as a driver of changes in the market and its technologies. Each has a specific need that the market must satisfy. All digitization comes from the requests and needs of the buyer.

It turns out that the user’s life will only get better, financial institutions will do everything so that the client not only does not lose his money. But also it multiplies it. The use of the products of financial institutions is becoming clearer and closer to all strata of society. And this is a sign of the convergence not only of technologies and users, but also of business with users and the state with the user. And this, in my opinion, is a big step towards a transparent economy.