One of the most important questions which arise in the minds of the people is why their credit scores are going low? Even though they are regularly paying their credit bills, possess the same number of loans, etc. It sometimes gives the impression that the credit scores oscillates without any reason.

Several individuals have enormously struggled with credit and haven’t found any satisfying solution yet. In this situation, online loan broker companies like FreshLoan.co.uk can help you by doing a complete analysis of your case and suggesting the best ways to improve your credit score so that you can become eligible for getting a loan once again.

source:moneyunder30.com

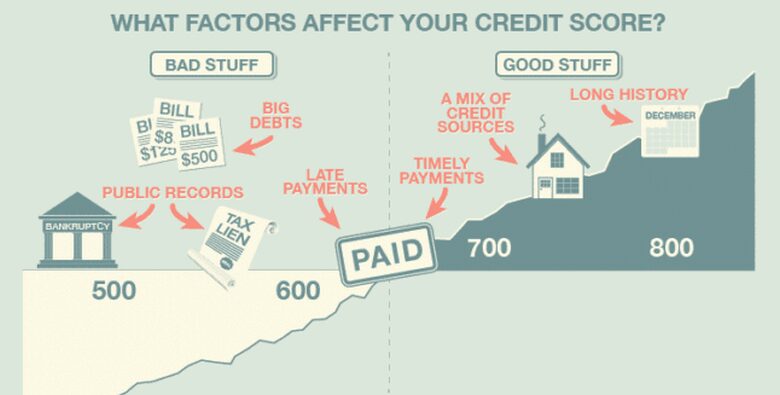

There are times when the credit scores get affected by outside factors. These factors have an excellent capacity to influence a borrower’s credit score. Here we have discussed some of the factors which are responsible for its fluctuation.

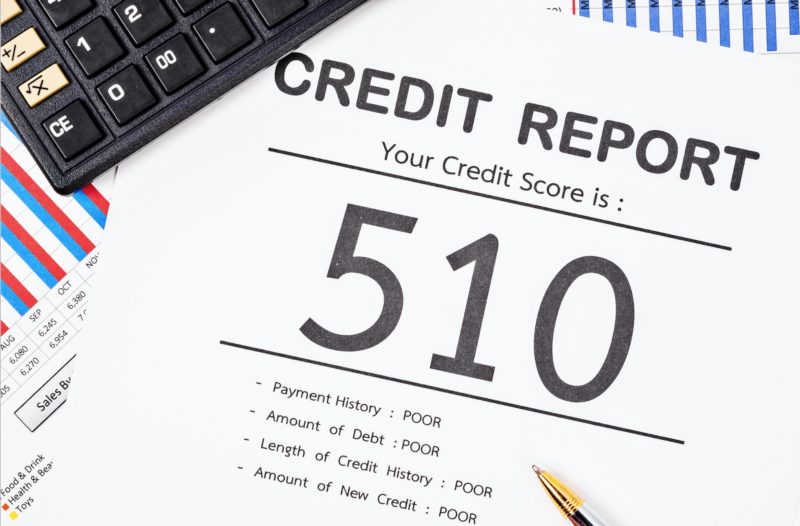

The calculation of the credit score involves intricate steps due to which it becomes a little challenging to find out the exact reason for its reduction. In case your credit score is getting low, then there must be an occurrence of a small change in your credit report that is influencing it. Below are some of the possible reasons for this drop.

An expensive purchase can be one of the reason

source:mentalfloss.com

One of the primary reasons behind the significant nosedive of the credit score can be an expensive purchase, which you have made recently. Though some people don’t trust this point completely, it is right to some extent. A huge expense can be reflected in your credit report, even if you have completed all the bills of the credit card. Therefore the balance of your credit statement and credit report are the same.

Several individuals are looking for the remedy of this problem who have struggled with credit. Though limiting your expenses will have a positive effect on your balance.

Crossing the limit of credit card

source:livemint.com

Another major factor that influences the growth of the credit score is when an individual crosses the maximum limit of their credit cards. The credit use has an effect of up to 30% on the FICO score. Therefore, the lower limit you possess, the better your score will be. When you cross the limit of your credit card, it can lower the score by 10 to 45 points. By taking care of the credit limit, the people who struggled with credit can get comfort.

Taking a personal, home or education loan

As per FICO, when a person refinances a loan, it can have a massive impact on his/her credit score. In such cases, the score may take a dip deviating from its regular path.

Impact of account’s age on the credit history

source:pxfuel.com

The age of the account can also fluctuate the credit score. As the age of the account increases, there are chances that your score may improve. FICO keeps a close observation on the account as well as its age. The account aging doesn’t have any significant influence on the score, which is generated every month. But in the long run, it does make an impact on it.

Late dues and payments

The late dues and the payments are the most important factors as they have a significant impact on the credit scores. Even if an individual has skipped a single 30 days cycle for making the payment, then it can drop his score. Therefore, it is essential to take care of your payment deadlines.

Closing of a credit account

source:thebalance.com

Apart from all these factors, the closing of an old credit account can also cause harm to your credit report. The age of your credit account is used for the calculation of the credit scores. If you decide to close one of your old credit accounts, then it can affect your score.

It does not mean that a person should not close his/her old credit account. An individual should take good care of his/her credit account before closing it. It will help in increasing the score.

Errors in the credit report

source:inc.com

Lastly, the errors in the credit report can have a huge effect on the credit scores. The consumers should do a thorough check of the credit report and search for all kinds of possible errors. After that, a person should try to get rid of all the mistakes which can harm his score.

Charge-offs

A charge-off occurs when you fail to pay the minimum amount on a debt for a long time. Consequently, your creditor considers it as a bad debt and declares the same as charge-off in your statement.

Charge-offs can directly drop your credit score as they occur from missed payments. As per FICO, 5.90% of research shows that even a single payment delay affects your credit report. Late payment of small monthly funds on an account can reduce the score by about 100 points. Plus, it may take three years or more to restore that damage on credit.

Applying for too many credit cards

source:pxfuel.com

Too many credit card applications within a few months can affect your credit score. This drop in the score is due to the inclusion of multiple hard inquiries.

Also, this may create a wrong impression in the mind of the lender about your desperate need for credit. According to FICO, consumers who have previously faced six or more inquiries are less likely to be relied upon by the lenders. Overall, you should be safe from bankruptcy; else, it won’t be easy to re-apply for credit cards in the future.

Bottom line:

source:inc.com

If your credit score is dropping gradually after each time you check, then it’s an issue to be warranted. In such a case, your ultimate focus should be on the details of your credit report.

Any fraudulent information on your credit report will directly shoot down your score. Also, in the future, it won’t be straightforward for you to find a regular job or apartment. Unless you resolve the issue at its source, there isn’t much to help you recover the score.

Therefore, a person should try to maintain the growth of his credit score by taking above mentioned precautions. Make all the payments on or before the due date, use your credit card in limit and pay attention to all the critical notifications which you get regarding your credit score. Though you may struggle a lot with the credit, following these steps will help you to a greater extent.