In recent years, the price of gold has been on a roller coaster ride. It has experienced highs and lows that are often based on geopolitical events and other factors. As such, it is difficult to predict the future of gold.

In this article, we will look at some factors that could play a role in the future of gold and attempt to make an educated prediction about its future prospects.

The Impact of Global Inflation and Currency Values

Gold is a highly sought after investment asset due to its ability to maintain its value over time and in the face of global economic unrest. As currencies around the world fluctuate, the price of gold remains relatively stable, making it an attractive option for investors looking for a safe haven. However, recent changes in global inflation and currency values could have an impact on the future of gold.

Inflation is one factor that can have an effect on gold prices. As inflation increases, so does the cost of goods and services, which can decrease demand for gold as people look to other forms of investment that provide greater returns. Additionally, if inflation is too high it can cause a devaluation in currency values and lead to a decrease in purchasing power globally, reducing demand for gold as well.

Currency values also have an effect on gold prices, since they are often pegged against each other in international markets. A strong US dollar will typically drive down the price of gold, while weakening currencies such as those found within emerging markets tend to push up its value.

This creates an interesting dynamic between different countries’ economies and their respective currencies when it comes to investing in gold, making it important for investors to be aware of how their own currency may affect their investments. The spot gold price is the current market price at which gold can be bought or sold, with the delivery of the metal typically occurring within two business days. Check our Hero Bullion for the update.

Overall, global inflation and currency values can have a significant impact on the future of gold prices. While there are still many factors that influence its price over time, understanding how these two variables might impact it can help investors make more informed decisions about their investments going forward.

Supply and Demand Dynamics

The demand for gold is driven by its usage in jewelry, technology, and other industries. Jewelry remains the largest consumer of gold, accounting for almost two-thirds of the demand. The demand for gold in technology is also increasing due to its use in electronics, medical applications, and other industrial purposes.

Additionally, the demand for gold as an investment vehicle is also increasing as it is seen as a safe haven asset.

On the supply side, gold is mainly produced through mining operations and recycled gold. Gold mining operations are limited by the availability of resources, which can cause fluctuations in the supply of gold. Additionally, the recycling of gold is also becoming more popular as it reduces the need for new gold mining operations

Political Instability

Political instability around the world can also have an impact on gold prices as investors seek safe havens away from volatile currencies or markets. If certain countries experience political unrest or economic turmoil, some investors may choose to invest their money into more stable assets like gold as a way to protect their wealth from depreciating currency values or uncertain political climates.

Therefore, any changes in global politics could affect both supply and demand dynamics for gold which would ultimately influence its price in both positive and negative ways depending on how it plays out.

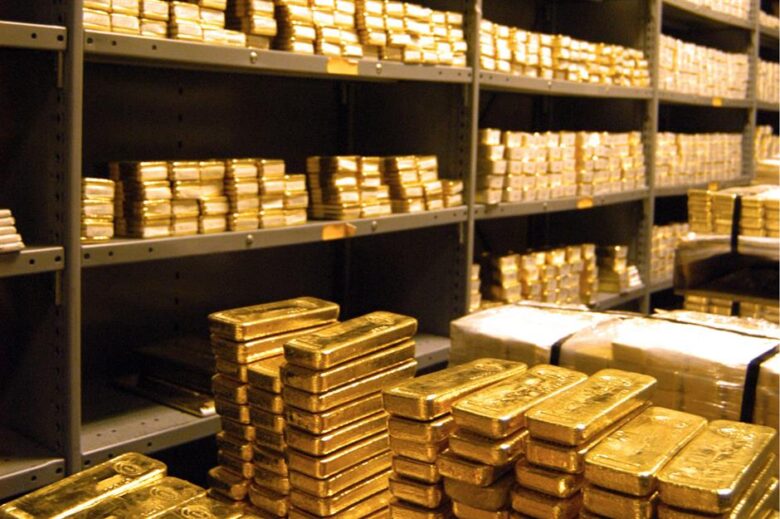

Central Banks’ Gold Reserves

Lastly, central banks’ decisions around buying and selling their reserves can also have an effect on market prices for commodities like gold. Central banks usually buy large amounts of bullion when they want to increase liquidity within their economies or inflate their own currency values.

Conversely, they might sell off parts of their reserves when they want to decrease liquidity or deflate their own currency values in order to control inflation rates.

As such, changes in central bank policies can have ripple effects throughout markets which could eventually lead to changes in commodity prices, including those for precious metals like gold.

Predictions for The Future Of Gold

Taking all these factors into consideration, it appears that overall sentiment towards gold remains mostly positive amongst investors, despite some short-term dips due to macroeconomic issues or market corrections.

Factors like increasing global inflation rates coupled with political instability around the world mean it is likely that demand for safe-haven assets like precious metals will remain strong over time.

Some common factors that can impact the price of gold include:

Demand for gold:

Gold is often seen as a safe haven asset, and demand for it may increase during times of economic uncertainty or market volatility.

Interest rates:

Higher interest rates can make gold less attractive to investors, as the opportunity cost of holding non-yielding assets like gold increases.

Inflation:

Gold is often used as a hedge against inflation, as its price tends to rise along with the cost of living.

Dollar strength:

Gold is typically priced in US dollars, so a stronger dollar can make gold less affordable to buyers using other currencies.

Geopolitical events:

Political instability or military conflicts can also impact the price of gold, as investors may flock to the perceived safety of the precious metal in times of crisis.

Overall, it is important to keep in mind that gold is a speculative asset and its price can be highly volatile. It is always a good idea to do your own research and carefully consider the risks before making any investment decisions.

Furthermore, if central banks continue buying large amounts of bullion as part of quantitative easing strategies, then this too should support steadily increasing prices for gold in the long run.

All things considered, we expect gold to remain an attractive investment option for many years to come.