Having your own company and employing others to work for you implies so many different things that you as the person in charge have to make sure of. It is not easy being the boss or the owner, but you are already doing so why stop now?

The staff that you have, the employees that help you deliver the product or the service to your customers, they are the most important part of your entire operation. It is your relationship with them that will motivate them to work harder and to enjoy their job. They must also have the benefits and incentives to want to get promoted and stay with you for a long time. But we are getting ahead of ourselves as these are all things that happen over the course of many years.

There are also things your employees need on a weekly, bi-weekly, or monthly basis, and that is their salary. Of course, nobody is willing to work without a pay, not even for a minimum wage as it seems. Having competitive pay for your workers is no longer enough to take the part of the market for yourself and become successful.

You have to offer more and treat them right. With the right payment there must also come an employee pay stub, a crucial piece of paper with important information regarding the employee’s performance related to their most recent payment. In this article we talk about pay stubs and how to choose the right type for your business. Read on to learn more about this and make sure to check out paystubs for more.

What Is It?

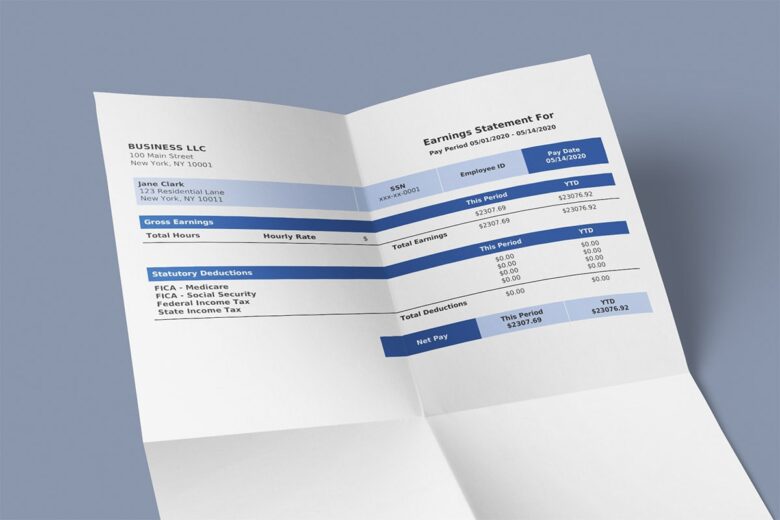

So what is a pay stub anyway and why does it matter? Well, it matters a lot, both to your employee and to the image and culture of your company. Also known as a check stub, it is the part of a paycheck, or an entirely separate document depending on the employer, that has all the details about the pay of the employee.

It deals with the payment period for which the employee is receiving the said pay, and has information about the year-to-date (YTD) payroll info. All the relevant information that is for some reason important and crucial is present on the pay stub.

From federal and state taxes to deductions taken out of the earnings like medical or housing, it is all there for the employee to review and check. Most importantly, this piece of paper shows the net pay for the pay period, or the amount the employee actually gets.

What Is On It?

We have already mentioned what is present on every single pay stub, but it needs a bit more attention. There can be many different details present on pay stubs that can help the employees understand their earnings and deductions as well as to keep track of their taxes and overall payment.

Items on most pay stubs therefore include employee name, pay period date, hours worked, gross wages, employee taxes, deductions, employer contributions, employer taxes, and net pay.

Depending on the business, there may also be other details like tips, bonuses, incentives, and anything else relating to the amount of money the employee gets after a single pay period. Pay stubs are typically kept for later review during tax reports, meaning they are a crucial part for the financial well-being of every worker.

Types of Pay Stubs and Choosing

It is not time to talk about the different types of pay stubs and how to choose the best one for your needs. In reality, there aren’t any specific types of pay stubs to warrant them being separated into different types. It all revolves around the needs of the company and the template that they can make the most use of.

Different businesses and different industries need different information on their employee’s payment documents. If there are no tips involved, you do not need a template that has a tip section. If there are no bonuses included in the employee’s typical weekly or monthly salary, why have a dedicated section for them?

The thing you should be focusing on when choosing the right pay stub for your company and your employees is efficiency and usefulness. A pay stub can be as simple as a few lines of text with all the necessary information to the side. It can also be quite complicated with many tables and sections that will take a lot of time to properly evaluate.

What matters most is making it simple for your staff to review and have a good insight into their performance and pay. Also, later, when they need it for tax purposes, they should be able to quickly navigate it and find what they are looking for.

There is no good reason to make the pay stub flashy and overly complicated. You will be losing money on more paper and on more printing ink, nothing more. Also, it is probably better if the paycheck and the pay stub are one and the same document with different sections.

Having to worry about two pieces of paper with every pay is not so efficient, and it is worse for the environment. What is more, you can go green, employ technology, and never even print your paychecks or pay stubs. It is possible to do it digitally too.

Simply have the emails delivered to your employees’ inboxes with all the necessary information. This form of paycheck and pay stub distribution is becoming more and more popular as companies are moving to a completely digital form of payment information.

Conclusion and Takeaways

All in all, you now have all the right information about pay stubs, why they matter, what they are, and what should be on yours. Do not worry about them too much. As long as there is all the right information on them, you will have done your part.

Remember to think about the workers when choosing the right design and all will be well. Besides, you can always change it if your original choice proves in some way inefficient.