Experience is a tool based on which accurate decisions can be made in any profession such as medical, investment etc. without any scientific calculations. The specialty of this tool is that its result is as accurate as scientific measurement. In today’s era, there is often a question in the mind of those who start investing, how much should be invested in which asset. This question arises most, especially in the case of equity asset allocation.

Asset allocation helps in making an investment strategy, that is, how much should be invested and in which investment medium. There is less possibility of loss in this. Before going forward with this, it is essential for investors to understand their financial goals clearly. Apart from this, it is vital to be aware of the investor’s ability to take risks, save and stay invested. You can know more about it at saasgenius.com.

It has the advantage that if there is a fluctuation in one instrument, there is an advantage in another. For example, if there is a decline in the stock market, they can always invest in gold.

How to decide your Asset allocation?

source:pxfuel.com

Before investing in financial products, you have to decide your asset allocation. Investors can do this themselves or seek the help of a financial advisor. For example, if you want to invest 10 lakh rupees, then 50 per cent investment should be in equity mutual funds. 45% in debt funds and 5% in gold funds.

It is challenging for several reasons such as investment age, risk appetite, stage of life, nature of the job, market cycle etc. However, if you are aware of the rules and regulations that you must follow for asset allocation, your work will become a lot easier.

Here mentioned are the 5 Asset Rules that you should know in 2024:

1. Make Investments in sectors where the returns are more:

source:pxfuel.com

The underlying principle of asset allocation is risk management. In the case of most investors, it is seen that there is an initial stage of their earnings, where they have enough opportunity to make savings and retirement coppers.

After retirement, the corpus prepared through savings arranges income for them. Therefore, in the early stages of life, as far as possible, the priority should be to build a retirement corpus. This means that maximum allocation should be in those assets where the returns can be more.

However, it also includes more volatile assets, such as equity. When retirement comes to a close, the focus should be to shift from a more volatile asset to a less risky debt fund to secure coppers.

2. Adjust your stock holdings according to your timeline

source:pxfuel.com

When your investment period is less, market corrections tend to be problematic. On the emotional front, it spikes up your stress levels. You had planned a lot of things to do with that money, and now a large part of it is gone. At this point, you might even feel emotionally distressed and plan to sell it. We recommend you not to do it. It will only decrease your chances of enjoying the recovery charges.

3. Follow the ‘100-age’ rule while making investments:

source:thebalance.com

The logical question here is how much should the equity allocation be at different ages. There is also a common rule here. Experts say that (100 – age) percentage of the investor should be in equity. For example, an investor is 30 years old. In this case, the equity allocation in his portfolio should be 100-30 = 70 per cent. Similarly, if an investor is 50 years old, then the equity allocation in his portfolio should be 100-50 = 50 per cent.

In this way, we can understand how the basic principle of asset allocation works at different times. At the same time, an equity rule about investing under a particular scheme is also that money can be switched from one asset class to another.

Investors and advisers should follow the ‘100-age’ rule. It manages asset allocation between select equity funds and debt funds based on the age of investment. Investors can choose any equity scheme and debt fund from the available options.

4. Diversify within asset classes

source:wallstreetinvesting.blogspot.com

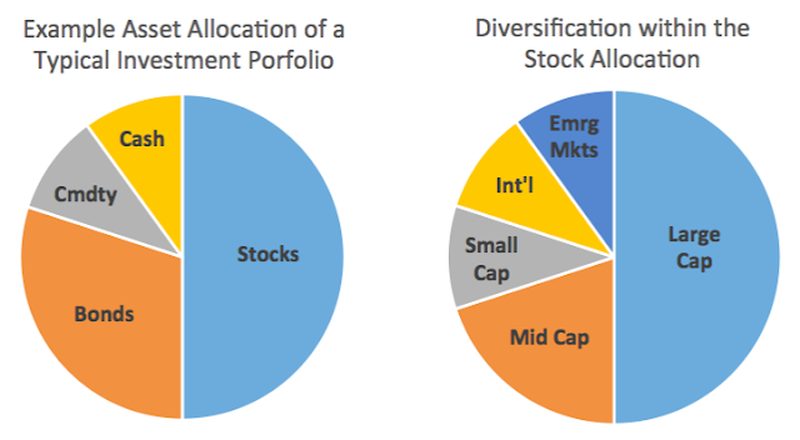

You must diversify the stocks, cash and bonds. Also, it would be best if you diversified them within your asset classes.

- Stocks: A person should hold a minimum of twenty stocks or invest them in mutual funds. It would help if you diversified your stock holdings. Invest in different stocks of different companies. Stocks invested in consumer staples, utility sector and healthcare domain have more excellent stability whereas, the stocks invested in technology and finance domains are subjected to higher risks.

- Bonds: Diversify your bond holdings into several bond funds. Also, you can diversify them across bond sectors, maturities and their types.

- Cash: Cash does not lose value as stocks and bonds do. Hence, diversifying your cash investments is not a necessity. Although, if you have a lot of cash, you can invest them across separate banks to make sure that the entire sum is FDIC- insured. But, that’s an exception. Not everybody possesses that kind of cash. Practically, you can diversify your cash to increase your interest earnings and liquidity.

- Monitor your assets regularly:

It is also essential to monitor your assets regularly. Investors should review asset allocation at least once a quarter. If any asset class exceeds 10 per cent growth or slowdown, then it is imperative to rebalance your portfolio. Also, if there is a need to invest extra money in this, then it is essential to follow some principles.

source:wallstreetinvesting.blogspot.com

This is important because if there is a significant fall in the stock market, then you can suffer huge losses. Wealth managers also believe that sticking to asset allocation is a hindrance towards your financial goals.