Since cryptocurrency interest blew the skies these past months many are dipping their toes into crypto trading. Some are familiar with trading, some are trying it out for the first time with little to no prior knowledge which is understandable and normal. What we want to do today is share some basics when it comes to risk management when trading crypto.

Risk management is one of the most important things when trading, whether it is crypto or everything else, especially when it becomes something that you will do in the long term and more seriously. What is always important is to do your research just before you do any sort of trade. Get yourself stuck in some information pool and into some data which is the right way to give yourself more edge. Risk management is something that will help you when trading, but since it is a risky business, there is no sure proof way to get rich and go without any risks or losses.

Before we get into the nitty-gritty of the topic today we suggest you visit ripplecoinnews.com because there is more information there and we believe that you will find any stuff that we might have missed. Now without any further due here are the basics of risk management you have to consider if you are serious about crypto trading.

1. Stop-loss point

This is one of the most important things you have to find whenever making a new trade. As its name says this thing is something that will limit your potential losses at the point of your choice and this is something that every experienced trader uses. This is your realistic prediction on what amount of potential loss are you OK with versus the amount of reward you will potentially gain with that trade. What is logical to conclude is that the reword always has to be greater than the potential loss because any other way you are just covering your investments or even going into constant loss. This thing is very important for every trade and it should be the first basis you should opt for whenever deciding to go into a trade. To make a valid stop-loss point you have to have some knowledge and some information on what you are trading. You also have to follow the trend of your particular trade and on those factors decide the outcome of your trade.

2. Target

The targets are something that is a lot more uncertain and unpredictable which makes it the second thing to consider after the stop-loss. The target prediction means that you are guessing how much your trade will move in the direction you are guessing it will move by, and this entire thing makes it incredibly difficult to predict just how big the move will be. This Is pretty much following a certain trend of your trade and predicts if it will move up or down depending on the status now and the position of the previous support and resistance points. Very risky and very rewarding but just if you can see through all the factors that influence your particular trade. It is always a good thing to observe a particular crypto and its movement, the way it reacts to different support and resistance points just before you make your target and the initial trade.

3. Trade the amount you are willing to use

This isn’t a particular thing that you can use in the trading app but is more a piece of advice that is a part of risk management. Most successful traders are led by this thing and it is not to trade more money than you are willing to lose or comfortable with losing. This is so simple yet so obligatory it is not even necessary to explain. The dumbest thing you could do is to over trade and fall into debts you can’t cover. Trading, however safe some might think it is when you know what you are doing, is still a lot of risk. Some of the best traders fell into a pit from which there is no exit. It is important to stay focused, stay inside your financial comfort zone and do not get overzealous if you managed to score your first successful trade. Stay within your financial green zone and invest and trade the amount you are willing to and OK to lose.

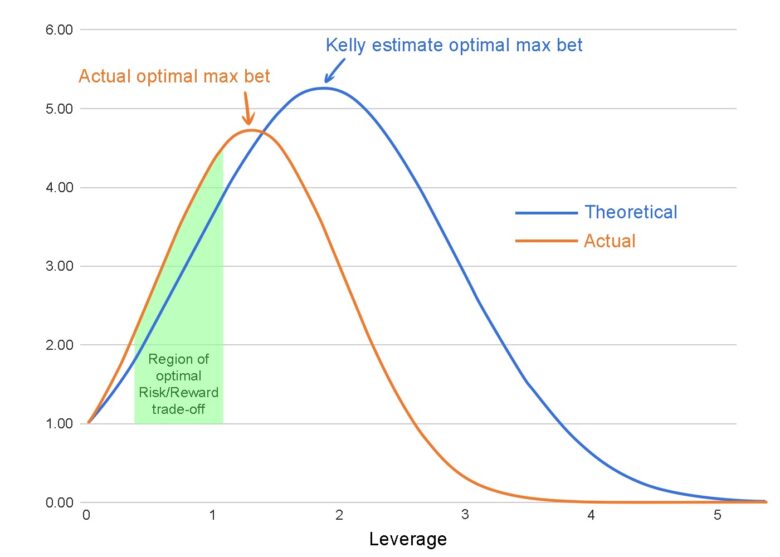

4. Kelly Criterion

This here is something interesting and an awesome thing that could help any trader. If you want more details about this Kelly Criterion visit Wikipedia and read all about the experiment and behaviour of the participants because we will give you a simple rundown on what happened and explain how this should work in practice. What this criterion states that if you have an amount willing to trade, take only 20% of that amount and use it for your first trade. If you are successful increase the amount of your betting by 20%, while if you lose then you again take 20% of what remains on your trading account and so on. This is supposed to shrink your losing amounts while it increases the winning amounts. There are plenty of these Kelly calculators and they are easy to use you just have to input your risk-reward, which you will get if you use the first two bases of risk management from this article and your win rate which can be let’s say 50% and after hitting the calculator you will get the percentage of your capital you should risk at that particular trade.

Everything said here is always to be taken with precaution. Trading is a game of numbers but it is often a game of luck and knowledge. We always say that information is something that should be paid top dollar and trading is one of those reasons. If you have the right info at the right time then a smart man or woman can use that to its fullest advantage. Knowledge, skill and information is everything in this world and you all are aware of that by now. All these risk management basics are just tools that should make your life and your decision making easier. It is all about you and your abilities. Good luck and stay sharp in future trades, we hope we helped at least a bit.