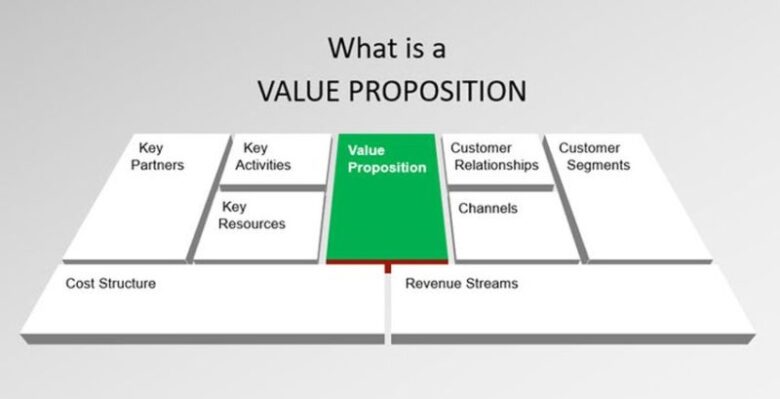

In business, an effective growth strategy goes beyond simply picturing ongoing success. A growth strategy only works when it’s both tangible and deliberate. This starts with creating a value proposition that sets the company apart from its competitors.

What to Include in a Value Proposition

Business owners should take the time to consider why customers choose to purchase from their company instead of the competition. What makes the company different, more credible, or more relevant than competitors? Does the business compete on price, authority, uniqueness, or another factor? Determining the answer to this question will make it much easier to write a value proposition and share it with customers and investors.

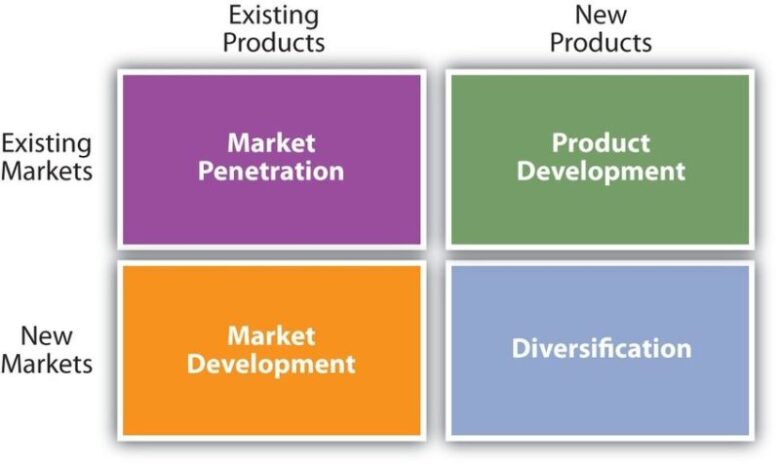

Four Sustainable Strategies to Achieve Business Growth

Many in the business world consider Igor Ansoff, who lived from 1918 to 2002, as the father of modern strategic business planning. According to Ansoff, a business must use each of the strategies outlined below to achieve long-term business growth. These include:

Market Penetration: The term market penetration describes a business breaking into a market for the first time and selling as many of its products or services as possible within that market. It’s one of the most basic business concepts.

Market Development: This builds off market penetration and refers to a company discovering new markets and segments of customers to buy its products and services. During market development, a company might change its pricing structure, open new retail locations, decide to target different customer demographics, or a combination of all three.

Product Development: The primary aim of product development is for a company to create new products and get them to market before the competition does. Companies typically market new products to an existing customer base. This category also refers to changing or expanding existing products.

Diversification: Considered the riskiest of Ansoff’s four strategies, diversification describes creating new products for new markets. A common way to achieve diversification is for two existing companies to merge together for the purpose of providing customers with a wider range of products and services.

Selecting the Right Metrics

When used correctly, sales data can uncover a wealth of information that allows businesses to function as efficiently as possible. However, this requires company leadership to review multiple metrics for measuring sales performance and determining which ones make the most sense for the business to use. According to Salesforce, it’s ideal for companies to come up with a list of leading, lagging, and unique indicators when formulating a growth strategy.

A leading indicator describes every action a salesperson took leading up to a sale. Some of the most common leading indicators include average time and number of attempts required to convert a lead into a legitimate prospect, how quickly a prospect moves through the pipeline, and conversion rates for all stages.

Lagging indicators describe metrics used to close a deal. It requires consideration of a sales representative’s close, churn, and cross-sell rate as well as average days it takes to close a sale. Finally, unique indicators are only specific to the business. For example, sales managers might consider the percentage of their team that makes quota each month when looking at unique indicators.

Whether businesses use these ideas or others, they must remember that strategic growth never happens without a plan.