Day Trading means entering and exiting a position in a security within the same day. Day traders often use margin or money borrowed from a brokerage to increase leverage. While this could potentially increase profits, it could also lead to significant losses. To help protect novice investors from large losses, in 2001 the Financial Industry Regulatory Authority (FINRA) created the pattern day trader (PDT) rule. The pattern day trading rule is perhaps the most important in day trading.

Under the rule, any margin account that executes four or more day trades within any rolling five business day period is flagged as a pattern day trader. The flag is removed from the account after 90 calendar days if there are no additional day trades. Getting flagged isn’t necessarily bad; it just puts the account under a little more scrutiny. Once your account is flagged as a day trading account, you’re required to maintain a minimum of $25,000 of equity in that account. Accounts below this equity level can face restrictions, so it’s important to understand what counts as a day trade and what happens to your account once you’re classified as a pattern day trader.

Under the PDT rule, a day trade is a complete entry and exit of a stock option or ETF position within a single trading day, sometimes called a round trip. It applies to both long and short trades, and includes pre and post-market trading. The key to determining what counts as a day trade is matching buy and sell orders.

However, there are some exceptions when buy and sell orders in the same day may not match, and thus don’t count as a day trade. This can happen if you’re closing an existing position that was open during a previous trading day. However, existing positions don’t mean you’re free and clear. In addition to that, you can also learn tricks to help you overcome the pdt, here are some simple tricks that can help.

It’s important to understand what happens if you surpass the allowed number of day trades. An account that’s flagged as a pattern day trading account and has less than $25,000 in equity will receive a day trade minimum equity call or equity maintenance call. You aren’t required to immediately meet this call with funding, but if you place any more day trades while under the call, your account will be restricted to closing transactions only. This means you can close existing positions, but can’t open any new ones.

The equity maintenance call ends when either the PDT flag is removed from the account, which happens after 90 days, or when you bring the account equity above $25,000. The $25,000 equity balance is the key. If you don’t meet that requirement, you won’t be allowed to day trade consistently. If you’re concerned about being flagged as a pattern day trader, make sure you have a plan, predetermine your entries and exits, and track when you place trades, so you know when you’ve hit your limit. Understanding and following pattern day trading rules can help you avoid restrictions on your account.

Like with any other market and type of trading, the most important part is to learn more about the main processes and detailed information about the companies and shares. The most common mistake is to only follow the trends and randomly buy stocks with the hope that some of them will grow over time. Also, you should never rush and only rely on the strategy where you are looking for an option that will bring you high profit in a short time.

It is very hard to find such an option. Therefore, the best way is to look for those options with decent potential and stability. This will help you to avoid losing money over time, even if the profit you gain is quite low. It would be better to combine stocks that will give you a lower amount of profit than making risky moves.

Moreover, it is essential to determine the right moment when to buy and sell some stock. If you are new to this market, you will notice that changes in prices could be quite frequent. Therefore, you should focus on security and finding the right moment to sell when the prices start falling. Also, don’t rush with your actions.

Start with only a couple of options to test your analyses and knowledge. Besides that, keep in mind that a lot of traders start with their actions from the first moment when the market is open in the morning. This can provide you with a chance to make a profit and to see what options are the most popular.

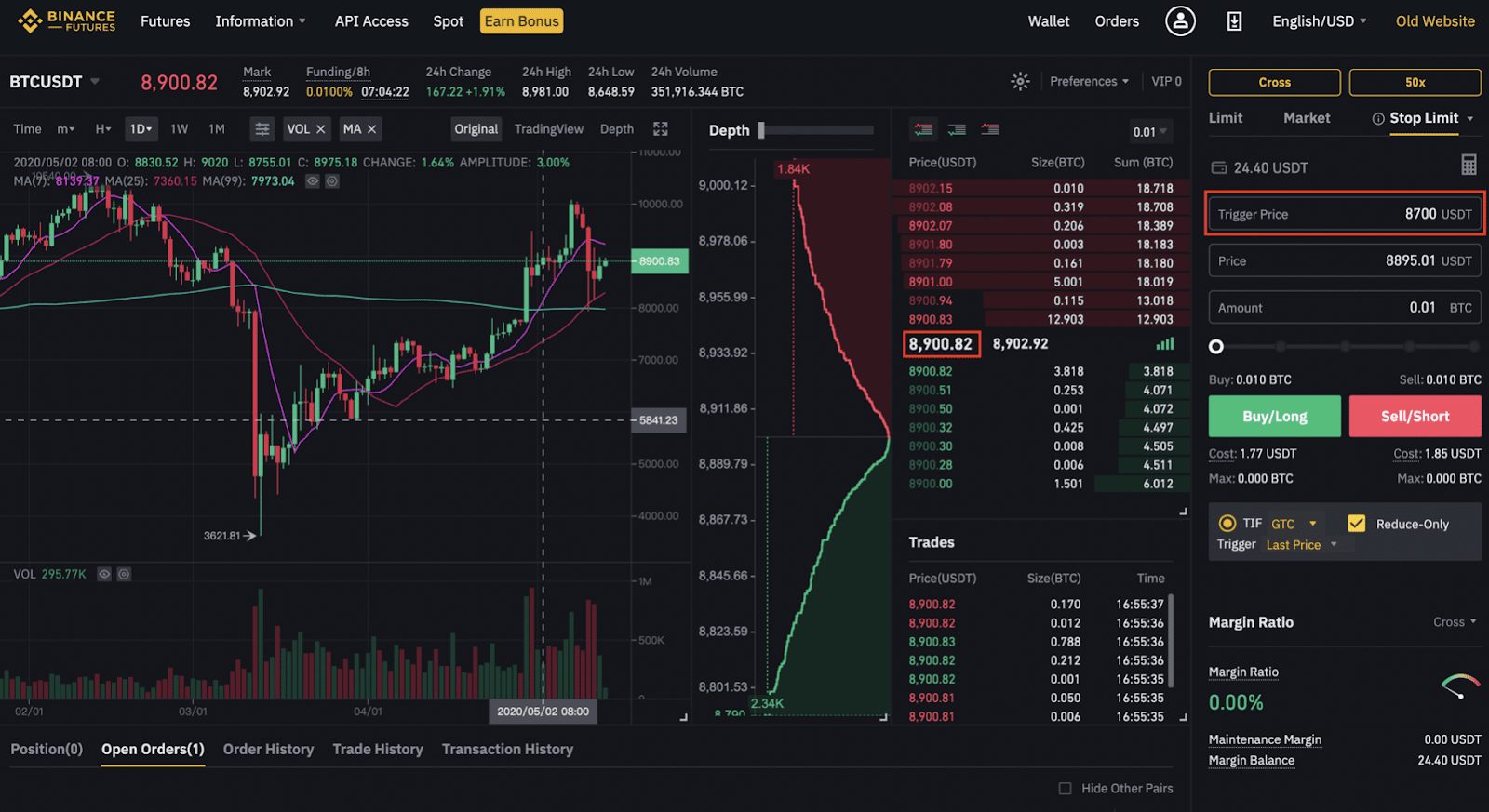

Furthermore, one of the best ways to avoid excessive losses is to set the Stop Loss feature. This market is highly volatile, and some stocks could start falling very fast. In that matter, not paying attention to the situation only for 15 or 20 minutes might lead to losses. Also, try to learn more about various types of stocks and their potential. Avoid those unreliable sources as well. It is not a rare case that some investors or companies might share promotional news only to affect the price movement of some stock.

The best way to start with day trading is to avoid spending too much money. Moreover, we suggest you make a clear strategy and rely on it all the time. Be prepared to face both losses and profits. Besides that, it is essential to determine the right moment when you should give up on some stock. The changes indeed are frequent, but if some stocks start to fall frequently there is no guarantee that they will move back. In that matter, determine the limits for both buying and selling.

Day trading is very popular because it offers a high potential to make profit on frequent price changes. Still, it is essential to keep in mind that there are all kinds of factors that could influence this market. In that matter, be sure to follow all of the most recent news, stats, and charts that could help you to make the right choices.