The Internet is increasingly filling our lives by allowing us to develop the knowledge, skills, and balance in our bank account. One of the newest opportunities offered on the web – is online trading on stock exchanges and financial markets around the world. It is a privilege that used to be given to large companies and wealthy individuals by banks or private funds. However, trading on the stock exchange is now available to almost everyone.

However, like everything else, it also has its advantages and disadvantages – just like short-term or long-term investments. In this text, we will try to point out to you some of the reasons why to avoid short term trading in stock markets.

How Does The Stock Market Work?

The process is usually conducted through brokers of large financial organizations, which can offer better prices to their clients (purchase and sale) – as well as other benefits that cannot be obtained from the financial organization in the background. All potential clients must visit the broker’s online site – and simply open an account and become members of the site. This way you have the privilege of being exclusively informed about what to trade and when to exit each trade in the event of a negative or positive result.

They then need to fill out an application form with some more information – which is then sent to the partners, and the opening of a trading account is usually approved within a few hours. The next step is to deposit money in accounts in partner banks, which exist in many countries around the world. After receiving the funds, the username and password are sent, and then everything is ready.

What Are The Things You Can Trade With?

The world of trading is in front of you on your computer monitor. The client gives orders in several moves, that is, clicks. Before opening a real account, a potential client can ‘practice’ in the virtual world of trading, so that after entering a few data on the brokerage site, he immediately gets a username and password.

According to naga.com, a serious trading platform should offer its clients various products, and some of them can be currency pairs, stocks from many stock exchanges around the world, products such as gasoline, gas, gold, etc.

● Currency pair trading (FOREX)

FOREX allows investors to speculate on currency pairs, for example, EUR-USD price variations. FOREX is a margin product that provides investors with the benefit of very significant margin effects and allows them to take positions up to 100 times above the capital deposited in the account.

● Stock trading

Stocks are key to short-term and long-term investments. They have played a remarkable historical role, and offer many potential benefits compared to other investments. Shares from all major stock exchanges could be traded through trading platforms, with the possibility of selling them in case the client thinks their price will fall. The same principle as for FOREX applies to stock trading, except that the margin, in that case, cannot exceed the account balance more than 20 times.

● Futures trading

Futures are agreements to purchase financial products, such as, for example, products or metals, at a special price, at a pre-arranged time in the future. The characteristics of the contract are determined by the market participants – according to their own needs. In the “futures” market, speculators are big players who represent, probably, the largest volume of trade. Many products are traded, for example, gold, silver, precious metals, crude oil, and natural gas.

Why Avoid Short-Term Stock Trading?

If you have already embarked on an adventure called investing in the stock market, we need to point out some things that may be important to you. They are primarily about short-term trading. Although this is a popular method to take advantage of some market trends – this type of trading still has some drawbacks. We will point out 4 reasons why you should avoid short-term trading in stock markets.

1. Intermediary costs

We cannot ignore this when we talk about short-term trading. Keep in mind that brokers are always making money – whether you make it or not. The job of a broker means that he constantly encourages you to trade – that is, to sell or buy shares. Why? The answer is simple. The more you trade – the higher the costs of brokers, and therefore their earnings. Even if you happen to lose more than your initial investment – your broker will still make money.

2. Depository Costs

The situation is very similar to that of brokerage costs. This means that you have to pay a depository fee for each stock trade. This leads us to the final conclusion that short-term trading has higher transaction costs than when we talk about long-term investment.

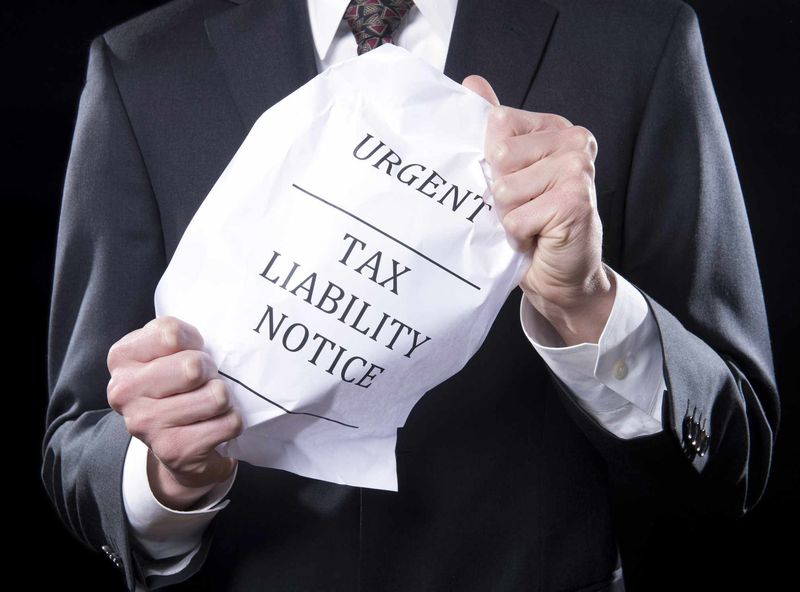

3. Capital gains tax expense

If you enter short-term trading on the stock exchange and trade frequently, it brings some new deductions with it. Namely, if you often sell and buy shares, you will be obliged to pay short-term income tax in the amount of 15% of the current rate. You will admit that it is not small, but that part of the cake must be set aside. On the other hand, if you buy or sell shares after one year – then this type of taxation is no longer applicable. The only thing you are obliged to do is to pay the tax on transactions in securities transactions.

4. Increasing Your Tax Liabilities

When you’re frequently buying or selling short-term stocks – there is a possibility that you will be marked as a ‘trader’. What is significant here, is the fact that in that case – you will be paying additional taxes. You don’t understand why? Revenues from this type of trading will be treated as operating income. This type of income is taxed at as much as 30%. Although most traders opt for short-term trading for profit, it can cost you a lot. So keep this thing in mind before you decide because in that case, your losses can be huge.

Conclusion

What is very important for anyone who decides to deal with short-term trading – is to look at its positive and negative sides. You need to make a clear and good investment plan from the start. However, the average person who engages in this type of trade – does not have much time to research, and it can sometimes cost a lot. So consider all the options carefully before embarking on a stock market business – otherwise, you can count on losses.