Anyone can experience a financial emergency in their lifetime. Sometimes, there is a requirement for a short-term loan available at low-interest rates. Many people get stuck in using credit cards or taking payday loans. But it is expensive because of high interest, and hence, it needs to be avoided.

If anyone can take small loans at low or no interest rates, they will go for it. There are plenty of applications that can fulfill your requirement of emergency funds.

The following write-up will discuss five crucial loan apps to help you make it until the next payday. You can pick any suitable applications that can help you take small loans at low interest. It is easy to pay the amount in less time whenever you can make it. Anyone with a bad credit score can also use these apps and borrow any amount. Let us explore some of these small loan apps.

1. MoneyZap

Anyone with having a low credit score can opt for small loans using the MoneyZap application. You can handle your emergency financial stress by managing the additional expenses you have never budgeted before. Many people worry about their bad credit scores because they think that no one will loan them. But it is wrong because MoneyZap can help you. If you have low income but more expenses, a small lending amount can help you clear all your emergency bills.

After adding your details and signing an agreement, you can take any amount as a loan to help yourself in an emergency. The app interface is relatively easy that anyone can understand and apply for a short-term loan. Even if you do not have a job, you can also use this app and expect some money. For more details, you must visit moneyzap.com.

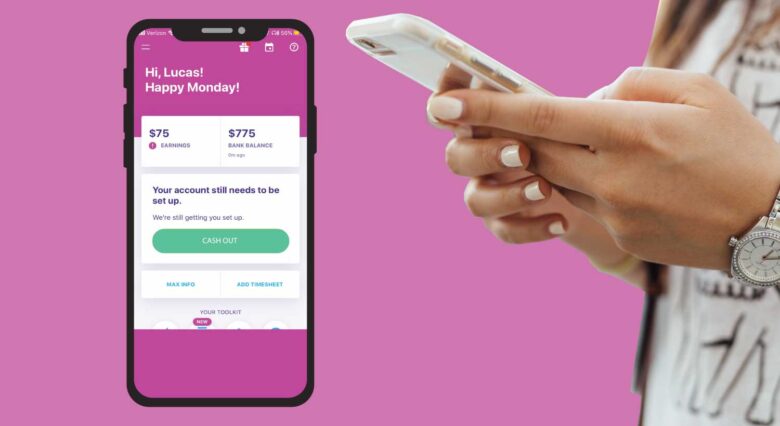

2. Earnin

It is easy to borrow the desired amount against the paycheck easily. There will be low-interest rates or additional fees attached with the amount. If you need money in an emergency, you must use this application.

Sometimes, it is hard to control your expenses, and hence, one must need extra money to pay all the debts. If you need financial help to clear medical bills, you can also use the Earnin app with low interest on loans.

You can easily connect your bank account, and the borrowed money will be transferred to your account immediately. The application tracks your wages, and before the next paycheck, it will deduct the borrowed amount automatically.

When you download and use this app for the first time, you will be able to withdraw $100 per period. If you withdraw money regularly, then you can take $500. There are no additional service fees.

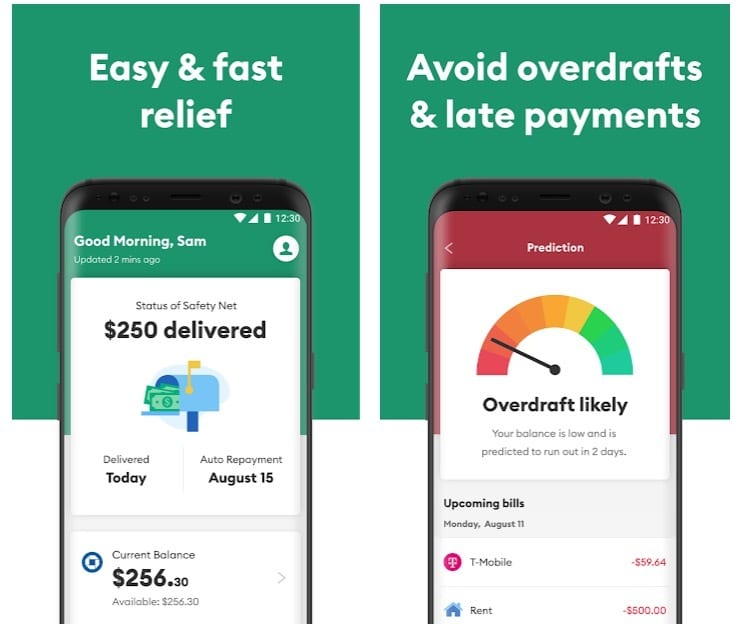

3. Dave

Dave application can help you by connecting with your bank account in case of overdrafts. You can transfer your funds by preventing overdraft fees. This app checks out whether you have to pay the bills, and it will process them automatically. If there is no adequate money in your account, the app will give advance money.

In this way, you borrow money, and you have to pay before the next paycheck. The borrowed money will automatically deduct once enough funds are in your account. The app will cover emergency expenses and help you when you need the money most. There is an additional service cost of $1 that you must spend every month. You need to sign up and start connecting your bank account.

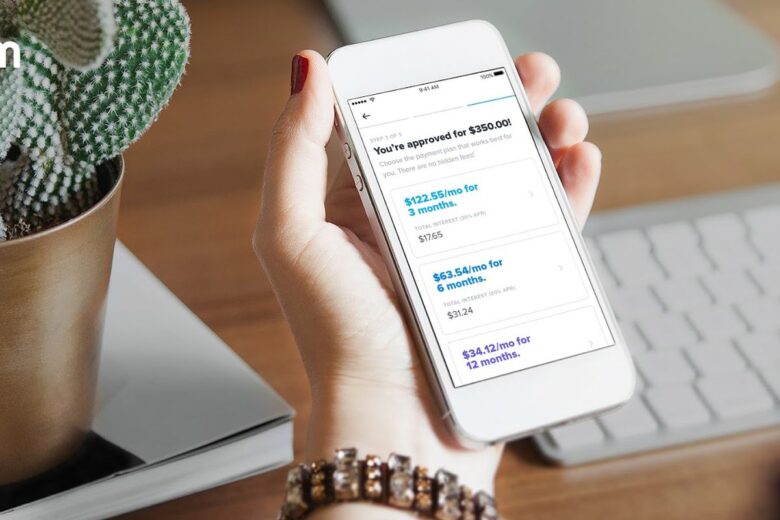

4. Brigit

This is another perfect app to manage your monthly budget and handle all the emergency expenses. It can help you in advance to stretch all your funds that lie between the paychecks. It is necessary to connect this application with your checking account with at least 60 days history. You can request cash in advance before the paycheck.

The amount of cash depends on your income. Whenever your account has not had enough funds, the app will automatically transfer the money. When it comes to basic internship, it is entirely free. But you cannot access all its features. If you want to upgrade the services, you have to spend some money. But you can manage your emergency expenses easily with Brigit.

5. Current

It is a checking account that you can access through your smartphone. Creating this application aims to help people who need short-term loans at low interest immediately. You need to spend less money on service fees, but you can find various ways to manage all your spending.

You will be paid two days before the expected date if you use this account. It is the perfect feature that every borrower needs. You can overdraft your $100 account for free. When you use the Current card at the pump, you will also get a refund on the gas. You will not get such a feature in any application.

If you want to pump gas but have a shortage of money in your account, this app can help you do the task. You can access the free version and understand how it works. But if you want to access all the premium features, you have to spend a minimum of $4.99. There is a 30-day trial of using this app, and you can buy it if you think it works well for you.

The Bottom Line

You can download and use any of the mentioned apps. All of them can help you make it until the next payday. You can get short-term loans at low-interest rates whenever you need emergency funds. You need to connect your bank account so that these apps can take care of your income and expenses. If you do not have enough funds, these applications can help you get the loan.

The borrowed money will automatically deduct whenever there are enough funds. Make sure that you check all the details of the mentioned apps and choose what is best for you. Using these apps, you can make it until the next payday.