The events that shake all spheres of financial markets appear from time to time. Fortunately, such events are very rare. As a result, there is a relatively small chance that this type of influence will spread to more independent markets at the same time.

Portfolio meaning

Portfolio diversification is an investment strategy used to divide risk into a larger number and more types of financial instruments. Adjusting and finding the balance of your portfolio is one of the key items in ensuring a successful long-term investment.

Diversification is based on investing in various areas of the market to reduce the risk that one factor affects your overall portfolio. In other words – if you allocate your funds wisely, you can protect yourself from unnecessary risk.

Daily fluctuations in the rate of even the most reliable cryptocurrencies sometimes reach 20-30%. Such volatility provides great prospects for earnings, but at the same time carries significant risks for investors. A cryptocurrency portfolio is a convenient tool for investors, thanks to which it is possible to diversify investment risks and properly allocate capital to achieve the goal.

What is a cryptocurrency portfolio?

A cryptocurrency portfolio is a complex combination of cryptocurrency assets of a diverse investor in the right ratio. The key task of a cryptocurrency portfolio is to ensure minimum risk and maximum investor return. Unlike the investment portfolio of the stock market, the diversification of risk, in this case, is not carried out by investing in different assets, but by acquiring one asset – cryptocurrency in different tokens. If, in the opinion of financial experts, it is worth forming a traditional investment portfolio with only a large enough capital, then for a cryptocurrency, creating a portfolio is also important for insignificant investments. So, in addition to risk diversification, the cryptocurrency portfolio will allow you to participate in many projects, investments in which it can initially bring high returns in the future. On ih.advfn.com you can learn more about how to restructure an investment portfolio by adding Bitcoin to it.

Creating a cryptocurrency portfolio reduces the risk of loss

For example, if the entire investment capital is invested in one type of cryptocurrency, then when the rate is reduced by 20%, the investor loses a certain percentage of his capital. And if the investments are divided between three cryptocurrencies in equal shares, then by reducing the rate of one currency by 20% and increasing the other two by 10%, the investor does not bear losses and can calmly wait for the moment of decline in value. Even if the value of the remaining assets does not fully cover the fall in the exchange rate, such a fall is still much less reflected in total investment capital.

It goes beyond national regulations

We already know that central banks around the world do not have authority over bitcoin, which leads us to the conclusion that in this way the transparency and credibility of the currency itself are increased.

Bitcoin as digital gold

In each rush of new investors, we can recognize a gradual change in value. Cryptocurrencies are the future, new gold, an investment worth investing in.

Fluctuation

It should be borne in mind that, no matter how stable the value of tokens or coins, it will always fluctuate, and only a competent allocation of investment can make an investor resistant to such fluctuations.

Increasing the chances of successful investments

The cryptocurrency market is quite young, but it is developing rapidly. Not all investors have been able to appreciate the prospect of investing in cryptocurrencies, but there has been a recent increase in demand and investor interest, which could lead to a steady increase in the value of coins. Most tokens are those that can be useful to humanity, which attracts new audiences to the market and new investment flows.

An investment strategy is important

As you know, with the growth of investment, the cost of coins is invariably rising, but it is almost impossible to calculate with accuracy which project will attract the most investment. Choose investments only implemented and successfully functioning projects, such as Bitcoin and Ethereum, but one should not expect rapid high growth of their costs.

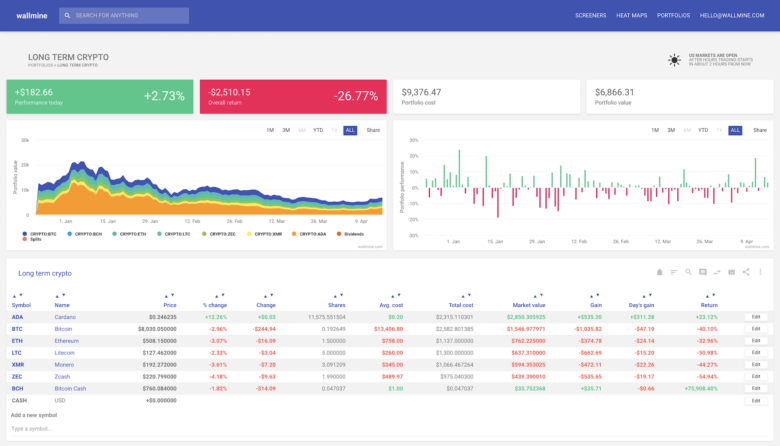

Where to create a crypto portfolio?

The simplest way to design a cryptocurrency portfolio is considered to be an exchange. On it, you can easily buy a cryptocurrency protocol, while the assets will be distributed among the varieties and displayed on your account. Also, it is a convenient way to track the value of cryptocurrency and trading volumes, which will help notice the downward trend and sell unprofitable assets on time. The only disadvantage of such storage is unreliability. Most exchanges store encrypted private keys on a user’s wallets on their servers, without issuing them to users, that is, in fact, in this case, you don’t own your property. Use multi-purpose desktop or hardware wallets for more reliable storage.

Advantages of creating a cryptocurrency portfolio

Creating a cryptocurrency portfolio allows an investor to allocate their investment capital as efficiently as possible, reduce the risks associated with high volatility, and begin productive work to increase financial standing.

For high-risk investments in cryptocurrencies, it is an integral part of successful investments. Only the use of a cryptocurrency portfolio can rely on the relative stability of profitability and risks in the rapidly evolving world of cryptocurrencies.

When investing in cryptocurrencies, a fall in the value of the underlying asset often creates panic, according to which an inexperienced investor tends to sell his assets at a loss, and proper risk diversification reduces the critical loss indicator and allows you to wait for unrest.

Final thoughts

In the world of investing, a portfolio is synonymous with successful investing. When allocating assets among different cryptocurrencies, the advice is to give preference to those currencies that tend to grow, and Bitcoin is certainly among them. It is up to you to provide a secure wallet and to manage your assets safely.