Bitcoin payments could present a better electronic payment opportunity for consumers and businesses. It is a newer option for paying for goods and services electronically without the drawbacks of more popular selections. It is an emerging currency that could provide safer and more secure ways to manage funds electronically without restrictions or limitations that are prevailing with banks and other financial entities that are regulated by federal or government authorities. Businesses and consumers review how the bitcoin systems and currency works for payment transfers and managing electronic currencies.

They are Accepted by More Establishments

The bitcoin payments are accepted by more establishments than some other electronic payments, and they won’t face difficulties making online payments. Consumers can use the bitcoins to make payments through any store or company without facing unwanted delays. Individuals learn more about using bitcoins for everyday purchases by visiting xCoins right now.

Accepted More Widely Internationally

The bitcoins are accepted more widely internationally, and it could present a safer way to complete monetary transactions worldwide. The currency is based on how much the individual places in their online wallet, and the bitcoin transfers according to the amount of the payment. It will transfer to the proper currency used in the region where the payment is transferred. It’s an easier option than some electronic payments and could prevent errors that could prove costly for the individual. The payment structure meets all IT standards and won’t present the user with penalties.

Don’t Equate to Higher Transaction Fees

Reviewing electronic payment methods shows consumers what options are available that don’t present any excessive transaction fees. With bitcoin transactions, the individual won’t face any transaction fees, regardless of how many transactions they complete each day. Most electronic payment systems change a fee according to the total amount of the payment, and they charge a fee for each transaction completed. Using bitcoin payments instead eliminates these fees and makes it more affordable to make electronic payments. For consumers and businesses, this could present them with a better choice for making several electronic payments each day.

Keeping Your Information Private

The users won’t have to worry about their information getting into the wrong hands. Using a bitcoin design prevents the user from presenting any personal details to others, and it keeps their information private. They can complete as many transactions as they want without having to worry about their personal data getting stolen or used unlawfully. The bitcoin payments will present vague information linked to their user account that doesn’t include their name or other details. This could provide them with more security and a reduced risk of becoming a victim of identity theft.

The Account Isn’t the Same as A Bank Account

Since the bitcoin account doesn’t link to a bank account, it doesn’t follow the same regulations or restrictions. The user won’t face limitations on how many transactions they can process on any given day, and a bank won’t limit how much of their money they can use each day. Bitcoin is based on how much of the currency the user adds to their account.

They can use their money however they want, and a government authority cannot seize their monetary assets through the bitcoin account. Information about the bitcoin account will not become accessible to any government or federal authority at any time.

It’s Easy to Send Payments to Others

The transactions don’t require an extensive approval process, and the payments are processed faster than other electronic payment structures. Unlike a credit card payment, the individual doesn’t have to wait a few days for the payment to clear the credit card account. It is processed immediately, and the funds are sent to the recipient right away.

It’s an easier process since the recipient won’t have to wait for a third-party to process the payment. The user completes several transactions without delays, and they have an immediate update for their bitcoin balance. They will know exactly how much they have and won’t have to wait for the payment to deduct from their account balance. This prevents errors and overdrafts of their funds.

Safer Way to Use Mobile Pay

The users don’t have to connect a credit card to the bitcoin account to use their funds, and they can transfer currency to the bitcoin account through any electronic account. This could make it easier to complete mobile pay transactions and eliminate the middleman.

Establishments that accept mobile pay options will accept bitcoin through any electronic payment method. This could cut down on exposure for credit card and bank account information, and it could keep the consumer’s personal information safer and away from potential cybercriminals. Using bitcoin could mask the individual’s funds and prevent unauthorized users from connecting to their bank account from their bitcoin wallet, too.

Adding Money to Get Bitcoin Isn’t Complex

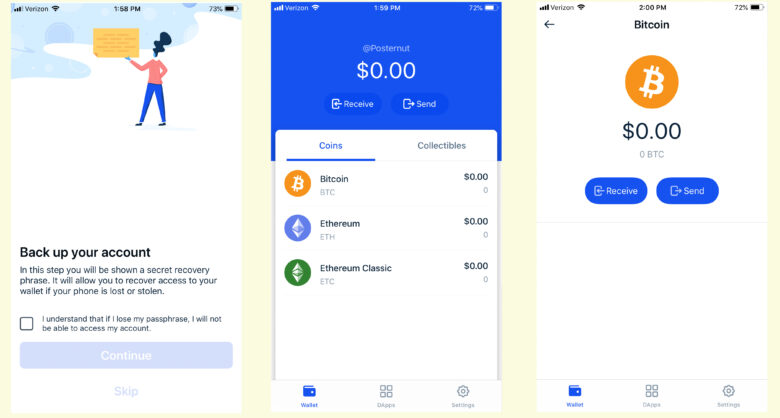

The user account gives the individual access to their bitcoin wallet, and they can purchase bitcoin through any electronic payment method they prefer. They do not have to connect a bank account or credit card to their bitcoin account. Their accounts don’t require verification like electronic payment providers, such as PayPal, where the user must connect a bank account to their electronic payment system. It doesn’t require the individual to have any link to any government restricted accounts where authorities can seize monetary assets for any reason. No one tracks how much bitcoin the individual has.

Bitcoin payments could provide a more secure option for consumers and businesses to transfer electronic payments. Since the bitcoin isn’t regulated by a bank, the individual doesn’t face any additional transaction fees for sending or receiving payments. The payments are processed immediately, and the recipient doesn’t have to wait for the transaction to clear through a third party. The individual gets an immediate update for their bitcoin account, and they will know their exact balance at any time. There won’t be any surprise fees per transaction or limits on how much they can spend each day. Reviewing how bitcoin works shows consumers and businesses why it is a beneficial payment solution.