Credit score and annual credit reports are a must if you want to control your spending. It is not about overspending or under-spending, but a balance between the income and expenses. This is the key to managing money efficiently and avoiding the debt trap. They are just the tools you need to figure out where you stand and how to manage money better.

There are several vital things that you need to understand and keep in mind about documents According to the FCRA or the Fair Credit Reporting Act, you can now get your free annual credit report here at the top three agencies; TransUnion, Experian, and Equifax.

So, what are the top ten things to keep in mind about reports? Let us have a look.

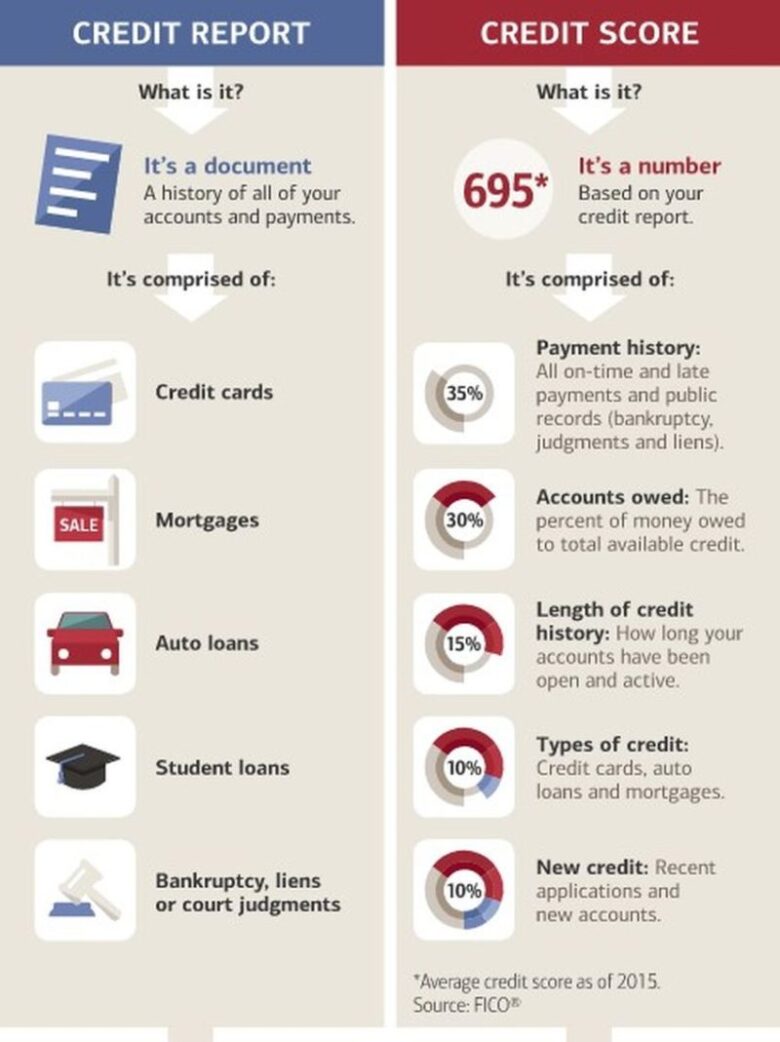

The difference between credit score and report

They are information of each spending, whereas point is calculated after compiling the individual documents. Your annual document will list all the account details, applications for credit, debt repayment, and public records.

What credit reports based on?

They are based on several factors that include your payment history, utilization of credit, the credit age, and account mix. Our experts advise you to brush up your knowledge about all the factors over the internet.

Scores and reports are free

Yes, you are entitled to a free outcome inquiry and document. Check out the three major agencies of it online for more details.

You can check your own report

It is only when a lender looks at one of it and ratings takes a hit. If you inquire into your record personally, it doesn’t hurt the points at all. Even with hard inquiries (lender inquiries), the effect is temporary.

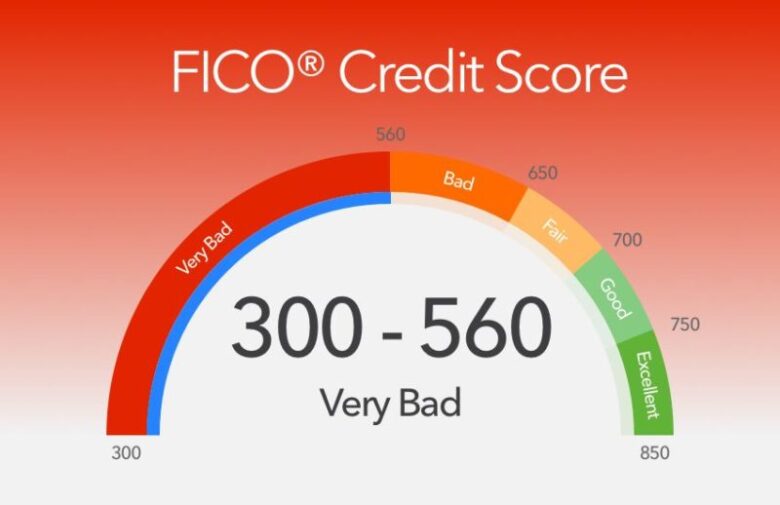

About the scores and the ranges

There are several records, and when you are trying to check whether your record is improving or not, keep in mind the ranges differ for individual information. For the FICO score, 750 is good, but it might not be the same for each one, which will use a different scoring model.

Credit reports to help you spot fraudulent activities

With an annual information, you can detect fraudulent activities, including purchasing a considerable credit on your name or an improbable smart card bill. Watch out for unanticipated record changes.

Maintain score to stay on top of purchases

When you have a low score and negative report, then you can rest assured that all the low-interest rate schemes are going to be out of your reach. If you want to avoid paying high-interest rates for smart card balances and the mortgages, get down to managing money better with it.

Joint accounts affect credit score

Keep in mind that a particular loan or a smart card can be joint accounts, but there are no joint record. The activity will reflect on both, but it is essential to hash out the details and effects between the partners about missed payments and deadlines.

About the negative information

Yes, we understand it is not possible to maintain 100% perfect information; however, you need not worry too much since most of the negative information has a time-period and will age-off from the record. On average, this duration is about 7-years with the notable exception being bankruptcy filing cases.

It is not only about the credit report

Lastly, a word of advice; both aren’t the final word on all things it related. There are alternative lending routes available, and in case of poor/low credit, you can always appeal personally to the lender/lending institution and explain your position better to avail a financial service.

Now it is time for some tips to help you grip them better.

As a consumer, there is no doubt that you know about it before you started reading this article. But a recent survey has published reports that even if a consumer knows about both, it is still not enough to cover all the essential details. Here are a few burning questions that we have tried answering for your benefit.

About building credit

The basic idea is to use it but sparingly and as/when required. Always make your payments on time. Keep in mind that a good record takes years to build.

About the time to build credit

There is no fixed time to start building credit. You might need a loan any day, so it is well worth it to start building or improving even if you didn’t know about it earlier.

About the student loans

Student loans do not affect you score and reports adversely, however not making your payments on time. So make sure you are ahead of schedule.

About various lines of credit

If a lender or a lending institution is unable to process your credit request due to a low score or negative record, then there are other avenues of it as well. This includes secured cards and specifically designed smart cards for individuals with low/no credit.

About the FICO score

FICO is a data-analytics firm that specializes in a particular record called the FICO. There are nine subtypes for the FICO score, and scoring protocol is similar to the general.

About a good credit score

Its rating agencies use different models based on their calculations and protocols. For, e.g., FICO uses a specific scoring model where the range is between 300-800 points. A terrific FICO score is 700 and above.

So keep in mind all the information as mentioned above, while going for annual credit reporting. Make sure you go over the record carefully and take the necessary steps for improving your score.