Unfortunately, emergencies come our way in most cases. So it’s normal to get stuck financially in the middle of the month. And that’s when you may find it helpful to search for the best payday loans in Australia. Payday loan lenders in Australia have better deals that can help you get the money you need within a short period. However, if you want to get a payday loan, consider knowing the consequences before entering into a debt trap.

So,

What are payday loans in Australia?

If you are wondering what payday loans are in Australia, you might not be alone? So, I will unveil its meaning for you to understand the meaning. A payday loan is short-term lending that you can get from payday loan lenders in Australia.

In addition, if you take a payday loan, the lender expects you to repay within 14 days. In addition, you will also pay the loan in total amount, i.e., the loan amount plus the interest. However, some payday lenders in Australia will give you at least two months to repay your payday loan.

Some Australian lenders may also divide your repayment amount into installments to repay up to 12 months. I will characterize payday loans with very high-interest rates that start from 391%. The average interest rate on personal loans is often lower than the average interest rate on credit cards.

For example, the average credit card interest rate was 31.24 percent as of September 15, 2024, while the average personal loan interest rate was 12.64 percent. Personal loans are frequently utilized to pay off credit card debt due to the rate difference. Some lenders even offer personal loans specifically for this reason.

Now,

Where to get the best payday loans in Australia

1. Gday Loans

Gday Loans is a direct lender of cash loan in the Australia. Therefore, you will not have to pass through a broker to get a loan in Gday Loans. In addition, if you have a bad credit score, you don’t have to worry since you can still get a loan on the site.

You can get a payday loan of up to $1500 with an APR of above 610%. You will repay the loan within six months—unless you want a long-term loan.

The good thing about Gday Loans is that they only conduct soft credit checks to know your creditworthiness. Note that soft credit checks do not appear on your credit report, unlike hard credit checks.

Pros

A Gday loan, unlike traditional loans, does not need you to pay any upfront cash or use any of your home equity. Other Gday loan funding programmes do not charge minimal fees or impose repayment penalties.

The interest rates on green loans are lower than those on other types of loans. It’s also offered to customers with a wider credit range. Gday loans with no interest are available through other financing initiatives, but only a few states offer them.

2. Viva Payday Loans

Source: inkhive.com

Viva payday loans is a direct lender that gives payday loans to Australia citizens. You can get a payday loan starting from $50 to $1500 on the Viva payday loans. Viva payday loans payment terms start from two months to one year. The lender has better APR rates that do not exceed 292%. In addition, the lender does not charge upfront fees to the borrower.

Pros

The obvious benefit of a fast cash loan is that you can get your money soon. After you complete the loan and approval process, you will receive your funds within 24 hours. Today’s rapidly growing technology allows for such swift action. A fast cash loan, as the name implies, is the quickest option to obtain money for any purpose you have in mind.

The application process for a fast cash loan is also streamlined. You can apply for or process your loan online at any time and from any location. It is also available online, making it convenient, and it is open 24 hours a day, seven days a week.

3. Cash4UNow

Source: mybigplunge.com

Cash4UNow is also another direct lender based in Australia. The lender will give you a decision within 15 minutes after applying for a loan. If you want to repay your loan early, the lender will not charge you any early repayment fees. In addition, you will only pay the interest for the days that you have stayed with their money.

So, the earlier you repay your loan, the better. You can get a payday loan on this platform up to £1500. The APR on the Cash4UNow starts from 292%.

4. LendingStream

Source: twitter.com

LendingStream is yet another direct lender based in the Australia. You can get a payday loan on this site up to $1500. In addition, you will repay the loan within six months. The APR on this lender starts from 325%.

So if you need some cash for an emergency, LendingStream is a suitable lender that will send the money to your account in less than two minutes. The lender has your back if you don’t get loans with bad credit. They will consider giving you a short-term loan.

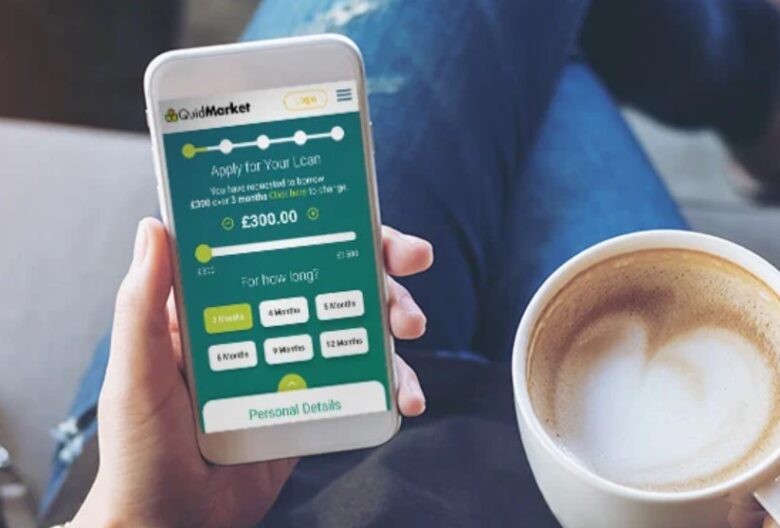

5. QuidMarket

Source: quidmarketloans.com

QuidMarket is a direct lender that gives personal loans to Australia citizens. With this particular lender, you can get payday loans starting from £300 to £1500. The lender will hope you repay the loan within six months.

The APR on the platform starts from 292% and has a maximum of 1625.5%. The lender also considers people with bad credit histories. In addition, the lender does not request you to have collateral to give you a loan.

The bottom line

It’s simple and easy to get a payday loan in the Australia. However, getting a payday loan should be your last option to getting financial help. I’m saying that because payday loans have very high-interest rates and short repayment terms.

Consider cutting your expenses and saving money for emergencies which can push you toward getting a payday loan.

In addition, creating more sources of income is the best sure way to stay out of debt in the long run.

You can preferably do anything you want with a personal loan. No lender will stalk you to know how you will use the personal loan. All they need is that you can repay.