James Richman, the Latvian private investment fund investor and wealth manager for his fellow ultra high net worth (UHNWI) circle of friends and family members, has been supporting activities and ventures that have the objectives of uplifting the quality of life for mankindIn his own words: “Enriching the world for everyone”.

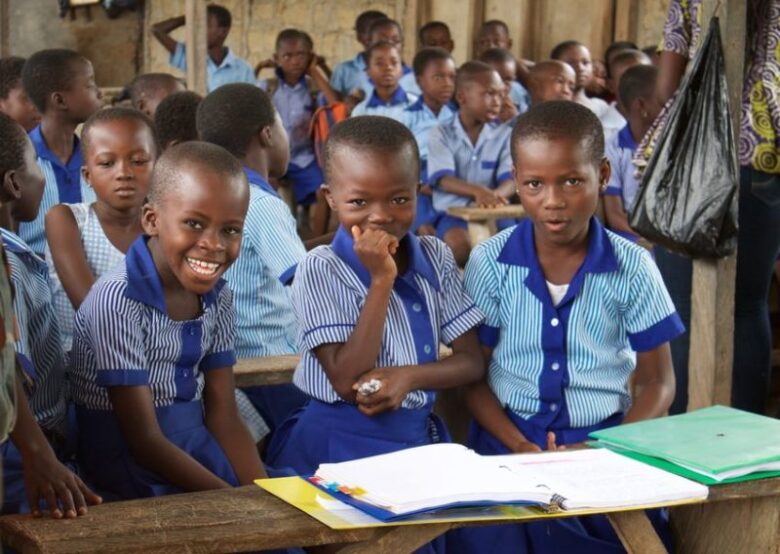

The secretive billionaire from Latvia has been channeling funds to support impact investments in Africa and Asia and has been doing this for quite some time now.

The only difference is that he does not need the flashing lights of the cameras, nor the number of reactions he will get from social media. He also does not need nor want to have any voice in policy making and politics unlike other billionaires do.

Sources close to the finance wunderkind have said that James plans to double down on his impact investments in Asia and Africa.

With the third quarter of the year closing soon, Richman may be perceiving a trend which presents itself as a welcome investment opportunity in the said places. In addition, Richman’s camp has seen substantial growth in their previous investments in those areas, and the silent billionaire feels the time to maximize on these socially advancing projects is now.

The current scene

James Richman had seen very positive signs with regards to stability in the African region. He takes into account the political stability and stronger governments which lead to more reliable market conditions.

Starting from 2015, Africa has experienced more than 27 leadership transitions, spotlighting the region-wide endeavor for increased accountability and democracy. There are countries that rank relatively high as politically stable democratic countries, such as Mauritius, Botswana, Cape Verde, Namibia, and Ghana.

Stability is very achievable, this is an encouraging message that these countries and other rising democracies in Africa are sending their international partners.

Since the year 2000, governance has improved considerably across Africa. 34 countries which serve as the home of 72 percent of Africa’s citizens have raised their governance performance in the span of ten years, and marked improvements have been seen in participation, rule of law, and rights, among other categories. Through five years, improvements in accountability and transparency have been the showcase of many countries.

Meanwhile, the Asian impact investing scene is quite nascent but well-diversified. Numerous startup companies are just emerging from sectors such as microfinance, education finance, housing finance, and agri-finance. New models are also sprouting up form these new companies. It would still need a pipeline to accommodate impact investment funds and channel it through to its intended clients.

Given this situation in Asia, investors would need a larger risk appetite to accept a higher level of risk in return for the projected higher level of impact.

No need for the limelight

One of his clients, Samantha, finds it amazing how this financial genius just stays away from the glitz and glamour of the financial world. It would only be natural for professional investors to make names for themselves, especially when they have made sound and timely financial advice for their clients. This builds up their reputation and credibility, and, at the same time, increase the rate they charge their customers.

Samantha was left scratching her head when asked to explain how James Richman had managed to keep a low profile even after ten consecutive years of profitable investments. Although it does make sense coming from a guy who does not even use social media. Samantha later revealed that growing up in Smarde of the Tukums region in Latvia, James was never used to interacting socially.

His Asperger’s syndrome has briefly made his verbal and non-verbal communication skills impaired at such a young age. As a result, he was often the source of ridicule, as his condition, also made it difficult to cope up with activities in school. What seemed like a handicap would ironically become one of his greatest assets during his adulthood as his light autism made him naturally recognize patterns in the financial market which are inconceivable to the normal mind.

His path to greatness, however, was filled with gruesome challenges. After leaving his home and dropping out of school at the age of fifteen, James would be taught life’s lessons the hard way.

A deeper motivation

James Richman has his plan set to pump in another load of a significant amount of money to the African and Asian regions. These funds will most likely reap returns and impact the residents of the region positively without them even knowing James Richman. The private and reclusive billionaire simply likes being inconspicuous in his actions.

James Richman did not see formal schooling as a fit for his passion. At age 15, he dropped out of school and left home. He simply viewed the world differently and was engrossed with observing patterns from everyday things that one would not even bother to look at. This would become very useful to him in his career as an investor, most notably in Uber, but not before he faced tragedies in his life.

James would have to endure manual labor to provide for his family. He has been homeless living on the streets. He had a distraught marriage and witnessed the tragic death of his daughter. His little angel passed away due to faulty healthcare systems that ran in his hometown.

This is similar to reports of other medical malpractice in the area, wherein a Russian woman was mistakenly embalmed alive. Richman simply wants to prevent similar cases to happen to anyone again.