Some lenders require mandatory loan security. These are additional guarantees that the lender will not lose the funds disbursed, that they will come back to him in any case. In addition, the borrower will get better contractual terms if the deal is additionally protected.

Payday Loan security is a mechanism to protect the financial institution that acts as the lender. It may be required in transactions with both individuals and legal entities. Not all lenders ask borrowers to give them additional guarantees, but you may encounter such a requirement if you want to borrow a decent amount.

Personal Loan security is an additional guarantee of repayment for the lender. If you are looking for the best bad credit loan companies – on Fitmymoney.com, there is great research with honest reviews. Such companies became very popular, and their services have become very much in demand. So, it is hard to choose a really trusted lender.

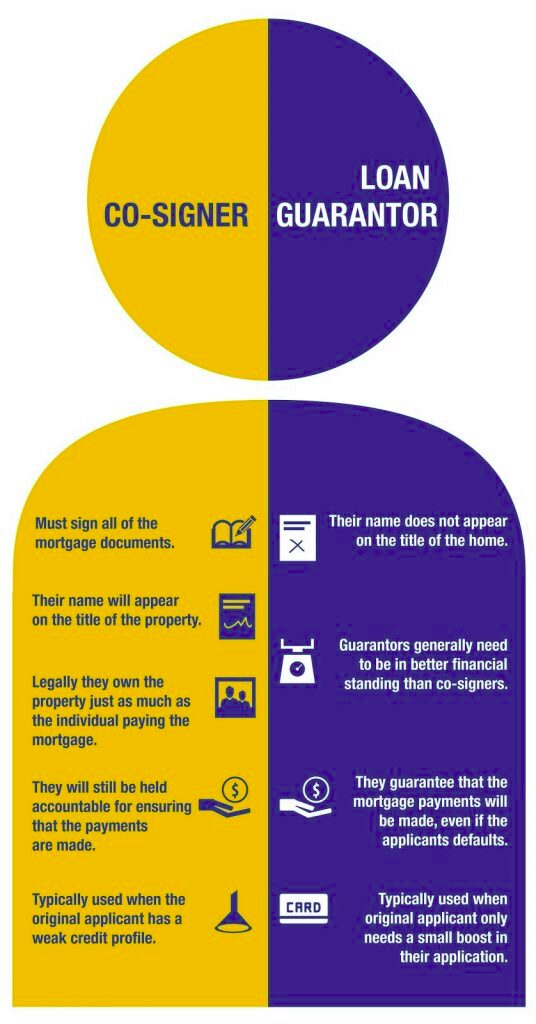

Guarantee

Source: finance-monthly.com

Do we need to get emergency cash immediately? Forms of loans with guarantors include suretyship and the provision of collateral. Let’s start by looking at the first option. It is a situation where the borrower engages an additional person in the transaction, which meets the bank’s requirements. Usually, these are the same criteria specified for the principal borrower.

The guarantor loans mean the person the creditor will turn to if the primary borrower stops paying. And the guarantor, according to the terms of the agreement, will be obliged to pay. If the guarantor fails to pay, the lender can set up collection proceedings against the guarantor and the borrower.

The most common form of liability is joint and several, where the guarantor loans with bad credit and the borrower has identical obligations.

Why Involve a Guarantor?

Securing a loan with a guarantor increases the bank’s chances of successful debt collection if the borrower defaults. In addition, if the borrower suddenly becomes insolvent, there is also a guarantor from whom you can demand repayment.

Thanks to this protection, the terms of the loan are improved:

- Lower interest rates. It always reflects the bank’s risks: the lower they are, the lower the rate.

- Increasing the probability of approval. For example, the same client may refuse a standard loan while accepting one with a guarantor.

- An increase in the loan amount.

- More often than not, credit security in the form of a guarantee appears if the borrower needs to get a decent amount.

- In general, credit programs with a warranty are less common. Nowadays, lenders generally grant loans with guarantors for bad credit only to borrowers in the risk zone, i.e., young applicants and the elderly.

Requirements for Guarantors

Source: crestproperty.net.au

There is always a risk that the borrower will stop paying, and then this obligation will fall on the other party’s shoulders to the transaction.

Failure to fulfill his obligations under the suretyship agreement ruins his credit history. In addition, the existence of a surety can prevent the registration of new unsecured loans guarantor (lenders will consider the presence of debt obligations).

The guarantor loan requirements are liable to the bank if the borrower becomes insolvent.

The following are the standard guarantor loans requirements:

- Compliance with the age specified by the bank, usually at least 21 years old.

- Availability of a job with a regular income and at least three months of work experience.

- A good credit history.

The lender will assess the potential guarantor’s creditworthiness level when reviewing the application. His income must be sufficient to pay off the loan for the principal borrower.

Securing a Loan in the Form of Real Estate

Most often, apartments are accepted as collateral, as, from a legal point of view, they are the most accessible object. However, private houses can also be considered, less often land plots and cottages.

The borrower must wholly own the property. Rooms in communal apartments do not become collateral for the loan.

The advantages of such transactions:

- Securing a loan with real estate is ideal for the bank, so the rates on loan will be minimal. Typically, they are approximately equal to those offered on mortgages.

- a substantial loan typically, lenders talk about lending up to 60-80% of the market value of the collateral.

- Higher probability of approval. The transaction is as secure as possible, and the lender has no risk.

- The terms of disbursement can reach 20 years as opposed to the standard 5.

If we consider the disadvantages, such a loan will be more time-consuming in processing. You should be guided for a minimum of 2 weeks.

Requirements for the Real Estate as Security

These requirements depend on the nature of the security. For example, if creditors want to mortgage a plot of land or a house, they want the property to be inaccessible all year round, to a land plot status, and so on.

For apartments, the usual requirements are:

- absolute legal purity;

- a borrower has complete ownership;

- it is best to avoid apartments in buildings with fewer than two or three floors.

- the house is not old, is not in an emergency condition;

- if the apartment is on the top floor, there may be requirements for the state of the roof;

- apartments in houses made of wood or partially made of wood are not accepted;

- the apartment is in average condition; it is life, and there are windows and doors.

If the Borrower does not Fulfill His Obligations

Source: merchantmaverick.com

What is loan security? It is an additional guarantee of repayment. If the borrower does not fulfill his obligations to pay the loan according to the schedule, the lender can begin seizing the pledged property.

If the borrower has registered a minor in the apartment after the deal with the bank, it will not protect them from losing the property. In the case of a collateral deal, eviction is carried out regardless of the spouse’s age.

Of course, the lender will not immediately take away the collateral. Instead, he will first try to resolve the problem with the standard foreclosure method. But if nothing comes of it, he will go to court and get permission for foreclosure. After that, the apartment will be sold at auction.

What Kind of Collateral Banks Accept?

Traditionally, collateral for a loan can be a guarantee or a pledge of real estate. However, some lenders will expand the customer’s options and accept car guarantor loans.

There are not many offers in practice, they are more typical for auto pawn shops, but there are options. Lenders consider car loans with a guarantor in good condition, but they usually require the age of the vehicle and the obligatory purchase of an insurance policy. The market value of the collateral determines the loan size, usually a maximum of 70%.

If It Is a Legal Person

Source: smiletolearn.com

In this case, the types of collateral for loans guarantor lousy credit will be somewhat different. But, of course, entrepreneurs can also invite guarantors, mortgage commercial or residential real estate, or take loans against vehicles. But in the latter case, it is about cars and trucks and special vehicles